Introduction: Why Plan G Is in the Spotlight

Medicare Supplement Plan G is the most popular Medigap plan for good reason. It offers extensive coverage, freedom from networks and referrals, and predictable costs. But in 2025 and into 2026, many Plan G policyholders are facing something new: double-digit rate increases and continued instability in pricing.

If you’re one of the many seniors in New York or across the country with a Plan G policy, you may be wondering: Why is my premium rising so quickly? What can I do to avoid it? And is there a smarter way to shop for Medigap coverage going forward?

Let’s explore what’s happening, how you can respond, and how MedicareHealthAdvisor.NYC can help you make smarter decisions.

Plan G Overview

- Most Comprehensive Coverage: Plan G covers all Medicare-approved expenses except the Part B deductible ($240 in 2025; projected $260+ in 2026).

- Freedom of Choice: No networks. See any doctor or specialist who accepts Medicare.

- No Referrals Needed: Direct access to specialists.

- Peace of Mind: After meeting the small annual deductible, you pay nothing out-of-pocket.

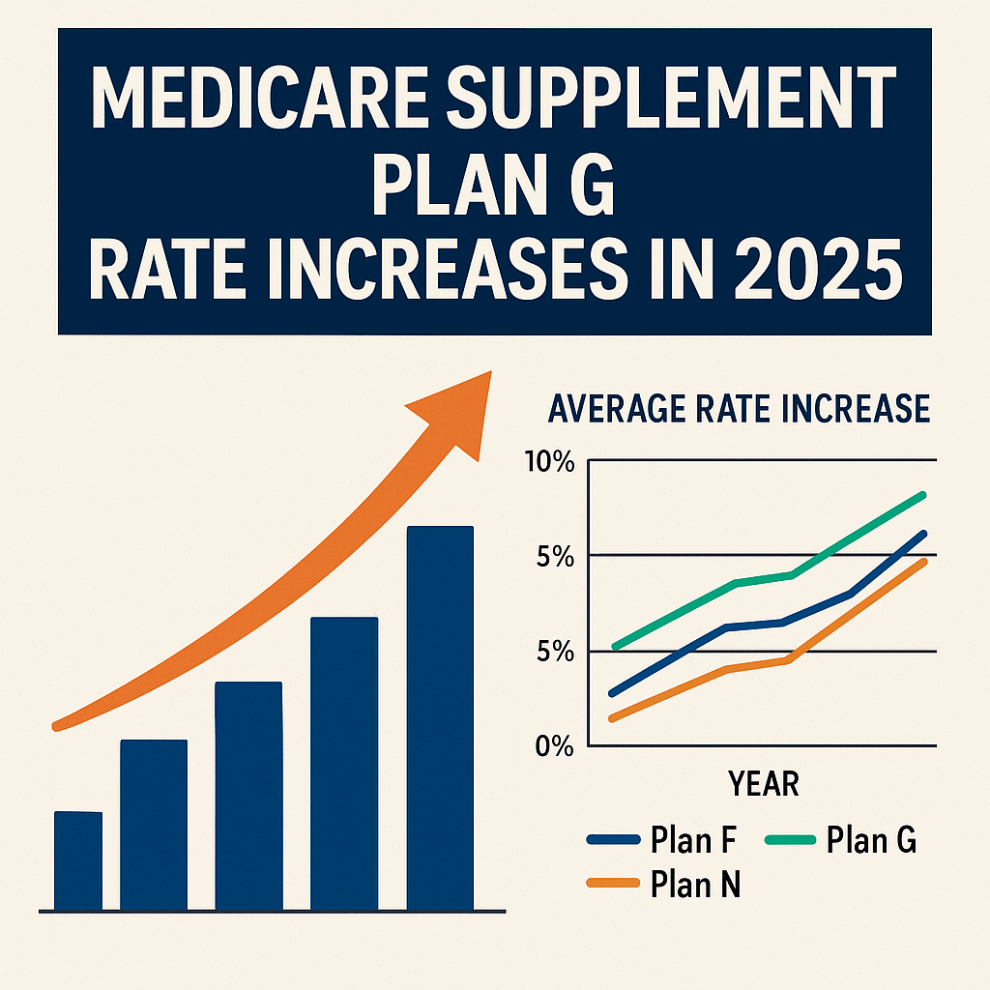

Recent Rate Hikes: The Numbers (2025–2026 Outlook)

Historically, Plan G premiums have increased about 4% to 7% annually. But in 2025 and projected into 2026, we’re seeing rate hikes of up to 40% in some states, especially in guaranteed-issue states like New York, California, and Illinois.

Here’s why:

- Post-COVID Utilization: People are using more healthcare again, catching up on delayed procedures.

- Aging Risk Pools: Older and less healthy populations increase claim costs.

- Inflation & Healthcare Costs: Rising prices affect medical services and insurance alike.

- New Guaranteed Issue Rules: More states are introducing Birthday Rules or GI rights, leading to higher average claims and fewer underwriting filters.

Plan G vs Other Options: Premium Trends (2025–2026 Projections)

| Plan Type | Avg. Annual Rate Increase | Typical Monthly Premium (Age 65) |

|---|---|---|

| Plan G | 8% – 15% in 2025/2026 | $140 – $240+ |

| High Deductible G | 3% – 7% | $40 – $90 |

| Plan N | 4% – 9% | $100 – $160 |

Note: Rates vary by state, age, gender, and tobacco use. Contact us for personalized quotes.

How to Avoid High Rate Increases

- Shop by Company: Not all carriers price Plan G the same. Some have better historical rate stability.

- Consider Plan N or High Deductible G: Lower monthly premiums with modest trade-offs.

- Switch During GI Windows: Use Birthday Rule or Anniversary Rule in your state to switch without medical underwriting.

- Review Annually: Compare new quotes every 12 months, especially before rate increases take effect.

- Work With an Expert: Independent brokers can help you identify companies with more stable pricing.

What Are Guaranteed Issue Rights?

Guaranteed Issue (GI) rules let you enroll in or switch Medigap plans without answering health questions. These typically apply:

- During your 6-month Medigap Open Enrollment Period when you first start Part B.

- When you lose employer coverage.

- In some states, annually (e.g., California, Oregon, Illinois, New York).

In NY, underwriting is never required — but that also leads to higher premiums overall due to increased risk for carriers.

How MedicareHealthAdvisor.NYC Helps You

- Licensed in Multiple States: Let us help you compare plans beyond New York.

- Access to 30+ Carriers: We shop the market for you.

- Free Service: No charge to you — our help is 100% free.

- Experienced Advisors: We understand underwriting, rate trends, and switching rules.

Next Steps

🎯 Take control of your Medicare costs before the next big rate hike hits!

- ✅ Call us today for a free consultation and personalized rate check.

- ✅ Ask about High Deductible Plan G to keep premium costs low without giving up coverage.

- ✅ Visit MedicareHealthAdvisor.NYC to compare plans, learn your options, and schedule a quick review.

Don’t wait until your next premium letter shocks you — let’s outsmart the rate hikes together.

MedicareHealthAdvisor.NYC — Your Trusted Medigap Experts.

Medicare Disclaimer: We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

If you have any questions, please reach out to us at info@medicarehealthadvisor.nyc or call 347-560-9396 — we’re here to help. The recent increases may also prompt you to consider Medicare Advantage Plans. Speak with a knowledgeable independent broker today at 347-560-9396.

Add Comment